-

Tax Policy Management

Tax Policy Management

-

Growth Management

Growth Management

-

Tax audit and litigation

Tax audit and litigation

-

Definition of a strategic and secure transfer pricing structure

Definition of a strategic and secure transfer pricing structure

-

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

-

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

-

Annual declaration and documentation obligations

Annual declaration and documentation obligations

-

Domestic and international VAT applicable to your company's flow

Domestic and international VAT applicable to your company's flow

-

Banking and financial VAT, VAT in the insurance sector

Banking and financial VAT, VAT in the insurance sector

-

VAT related to real estate registration fees

VAT related to real estate registration fees

-

VAT in the public and non-profit / association sector

VAT in the public and non-profit / association sector

-

Tax audit, tax litigation and relations with the Tax authorities

Tax audit, tax litigation and relations with the Tax authorities

-

Applicable rules for invoicing

Applicable rules for invoicing

-

Customs issues related to your company's international flows

Customs issues related to your company's international flows

-

French VAT registration and compliance obligations

French VAT registration and compliance obligations

-

Payroll tax

Payroll tax

-

Other indirect taxation

Other indirect taxation

-

Company transfer diagnosis

Company transfer diagnosis

-

Distribution strategy : Implementing and structuring

Distribution strategy : Implementing and structuring

-

Distribution activities digitalisation

Distribution activities digitalisation

-

Relations between suppliers and distributors

Relations between suppliers and distributors

-

Contractual policy : etablishing and structuring

Contractual policy : etablishing and structuring

-

Controls and litigation regarding payment terms

Controls and litigation regarding payment terms

-

Organising and securing commercial relations with consumers

Organising and securing commercial relations with consumers

-

Data protection - GDPR

Data protection - GDPR

-

Commercial Leases

Support in the management and contract management of commercial leases.

-

Traditional Services offered

Traditional Services offered

-

Health at work and quality of life at work

Health at work and quality of life at work

-

HR Management Audit

HR Management Audit

-

HR Engineering and People Change

Implementing managerial solutions in line with the company's strategic challenges

-

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

-

Advice on legal structuring

Advice on legal structuring

-

Day to day company management

Day to day company management

-

Companies reorganisation

Companies reorganisation

-

Mergers & Acquisitions - Private Equity

Mergers & Acquisitions - Private Equity

-

Changes in shareholder structure - Securities issue

Changes in shareholder structure - Securities issue

-

Governance and legal risks management

Governance and legal risks management

-

Development of an international mobility policy

Development of an international mobility policy

-

Coordination of reporting obligations for employees in a mobility situation

Coordination of reporting obligations for employees in a mobility situation

-

Advice on social security

Advice on social security

-

Assistance in labour law

Assistance in labour law

-

Management and protection of your portfolio of property rights

We put the most appropriate protection policy in place for our clients’ intellectual property rights.

-

Securing your projects: advisory and drafting of agreement services

We advise you on the feasibility of your project and the securing of your intellectual property and IT rights.

-

Enforcement of your rights: pre-litigation and litigation

Enforcement of your rights: detection of infringement, pre-litigation and litigation

On 30 December 2023, the Finance Act for 2024 (“LDF24”) was published, following its approval by the French Constitutional Council on 28 December 2023. The Act includes significant measures relating to corporate tax.

Transposition of the « Pillar 2 » directive (Art. 33)

One of the key measures presented in the PLF24 is the transposition of the EU directive aimed at ensuring a minimum level of international taxation for groups of companies in accordance with the Global Anti-Base Erosion (GloBE) rules.

This measure introduces a minimum tax rate of 15% on the profits of multinational and national groups of companies with an annual consolidated turnover of €750m or more in at least 2 of the 4 financial years preceding the financial year in question.

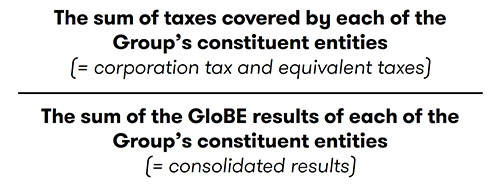

The effective tax rate (ETR) of the Group will have to be determined for each State or territory and for each financial year in accordance with the following formula:

In the event of a tax shortfall in a jurisdiction, the additional corporate tax can be collected through 3 different mechanisms:

- the Income Inclusion Rule (RIR);

- the Insufficiently Taxed Profits Rule (RBII);

- the Domestic Top-up Tax Rule (INC).

The annual minimum tax applies to fiscal years beginning on or after 31 December 2023 (except for the RBII part which will only come into force for tax years beginning on or after 31/12/2024).

The LDF24 also includes a provision for temporary tax relief for financial years beginning before 31 December 2026 and ending no later than 30 June 2028, based on the CbCR declaration whereby the additional tax is deemed to be nil in a jurisdiction if:

- Total revenues < €10m and pre-tax profits < 1m€ OR

- Simplified taxes covered / Pre-tax profits >15% (2024),16% (2025),17% (2026) OR

- Tax allowance based on substance > pre-tax profits.

Introduction of a tax credit for investments in green industry (Art. 35)

The LDF24 provides for the creation of a tax credit for investments in green industry (C3IV), to be granted to companies which invest in capital expenditure other than for capital replacement, and in activities which contribute to the production of batteries, solar panels, wind turbines or heat pumps.

The rate of the C3IV is 20% and increased to 25% or 40% according to the geographical zone of the investment. The total amount of the C3IV is capped at €150m per company (raised to €200m or €350m in regionally aided zones “ZAFR” or outermost regions “RUP”).

The C3IV is granted with prior approval, and subject to the investments being carried out in compliance with tax, social and environmental legislation over a minimum of 5 years (3 years for SMEs), to companies that can demonstrate the following:

- the eligibility of their investments;

- the economic viability of their investment plan (evidence can be provided by any means);

- the investment plan provides for at least 50% of the turnover being achieved with companies that carry out an activity deemed as eligible.

The C3IV will apply to approved investment projects until 31 December 2025

Changes to the measure for innovative young companies “JEI” (Art. 44 et 48)

As from 1 January 2024, the LDF24 cancels the corporate tax exemption for the creation of innovative young companies or “JEI”, considering this measure to be no longer necessary (the exemption from social security contributions is, however, maintained).

The status of JEI is extended by the creation of a new category of company: JEC or « jeunes entreprises de croissance » (young high-growth companies), corresponding to SMEs where between 5% and 15% of total expenditure is in R&D and where certain economic performance indicators defined by decree are met.

Dividends and the share of costs and expenses “QPFC”: brought into line with case law (Art. 52)

In accordance with European case law (ruling of 11 May 2023 of the Court of Justice of the European Union relating to the companies Manitou BF and Bricolage Investissement France), the reduced rate of 1% for the share of costs and expenses (QPFC) and the 99% exemption (where a company’s dividends do not qualify for the parent-subsidiary regime) will now apply to all dividends received from European subsidiaries that meet the conditions for forming an integrated group with their French parent company, and this regardless of whether or not the latter has opted for tax consolidation.

However, dividends paid between companies established in France that have voluntarily opted not to form an integrated group despite meeting the conditions for doing so, remain subject to tax.

Lastly, the LDF24 re-introduces a minimum period of belonging to a tax group of one financial year before qualifying for the reduced rate of 1%, during which the dividends distributed between member companies will be subject to the rate of 5% of the QPFC.

These measures apply to financial years ending as from 31 December 2023.

Postponement of the abolition of the CVAE (Art. 79)

The abolition of the CVAE will be staggered until 2027 with a gradual reduction in the maximum tax rates (i.e. 0.28% for 2024, 0.19% for 2025, 0.09% for 2026).

Concerning the minimum contribution on the value added of companies (€63), this will be abolished from 2024.

Deferral of electronic invoicing obligations (Art. 91)

The initial dates set for the obligation of companies to e-invoice and for certain e-reporting obligations to the French authorities have been deferred:

- Obligation for all businesses to receive electronic invoices: 1 September 2026

- E-invoicing and e-reporting obligations: 1st September 2026 for large companies, for members of a single taxable entity and for midcaps, and 1st September 2027 for SMEs and micro-enterprises

Implementation of the anti-fraud plan (Art. 112 et 113)

The LDF24 implements a number of measures relative to the repressive tax matters of the plan in order to combat all forms of public finance fraud, such as:

- Strengthening the legal framework applicable to VAT fraud (Art. 112):

- Extension of the VAT reverse charge by the customer for the transfer of guarantees of origin certificates, capacity guarantee certificates and production certificates provided for in the Energy Code;

- Liability of dropshipping businesses for import VAT on distance sales of imported goods except where they can prove that the VAT was charged on the full price of the goods at the time of importation into France;

- Creation of a tax compliance injunction for non-EU providers of electronic services that engage in economic activities from outside the EU without paying the VAT due in France.

- Strengthening the resources which are available to the French tax authorities in order to detect and punish tax fraud (Art. 112):

- Extension of the possibility for tax officials to collect data via online platforms and to use pseudonyms on the Internet;

- The creation of a graduated penalty system to be applied to fraudulent claims for state aid in France.

Greater flexibility of the conditions for carrying out controls (Art. 117)

Audits of a company’s accounts and on-site inspections may now in exceptional cases be carried out away from the company premises, provided that the taxpayer consents.

Tax officials will also be able to carry out their duties anonymously.

These measures will apply as from 1 January 2024 and to tax audits already in progress and undertaken on or after that date.

Transfer Pricing (Art. 116)

Find out more about the measures relating to transfer pricing in the special alert written by our experts here.