-

Tax Policy Management

Tax Policy Management

-

Growth Management

Growth Management

-

Tax audit and litigation

Tax audit and litigation

-

Definition of a strategic and secure transfer pricing structure

Definition of a strategic and secure transfer pricing structure

-

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

-

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

-

Annual declaration and documentation obligations

Annual declaration and documentation obligations

-

Domestic and international VAT applicable to your company's flow

Domestic and international VAT applicable to your company's flow

-

Banking and financial VAT, VAT in the insurance sector

Banking and financial VAT, VAT in the insurance sector

-

VAT related to real estate registration fees

VAT related to real estate registration fees

-

VAT in the public and non-profit / association sector

VAT in the public and non-profit / association sector

-

Tax audit, tax litigation and relations with the Tax authorities

Tax audit, tax litigation and relations with the Tax authorities

-

Applicable rules for invoicing

Applicable rules for invoicing

-

Customs issues related to your company's international flows

Customs issues related to your company's international flows

-

French VAT registration and compliance obligations

French VAT registration and compliance obligations

-

Payroll tax

Payroll tax

-

Other indirect taxation

Other indirect taxation

-

Company transfer diagnosis

Company transfer diagnosis

-

Distribution strategy : Implementing and structuring

Distribution strategy : Implementing and structuring

-

Distribution activities digitalisation

Distribution activities digitalisation

-

Relations between suppliers and distributors

Relations between suppliers and distributors

-

Contractual policy : etablishing and structuring

Contractual policy : etablishing and structuring

-

Controls and litigation regarding payment terms

Controls and litigation regarding payment terms

-

Organising and securing commercial relations with consumers

Organising and securing commercial relations with consumers

-

Data protection - GDPR

Data protection - GDPR

-

Commercial Leases

Support in the management and contract management of commercial leases.

-

Traditional Services offered

Traditional Services offered

-

Health at work and quality of life at work

Health at work and quality of life at work

-

HR Management Audit

HR Management Audit

-

HR Engineering and People Change

Implementing managerial solutions in line with the company's strategic challenges

-

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

-

Advice on legal structuring

Advice on legal structuring

-

Day to day company management

Day to day company management

-

Companies reorganisation

Companies reorganisation

-

Mergers & Acquisitions - Private Equity

Mergers & Acquisitions - Private Equity

-

Changes in shareholder structure - Securities issue

Changes in shareholder structure - Securities issue

-

Governance and legal risks management

Governance and legal risks management

-

Development of an international mobility policy

Development of an international mobility policy

-

Coordination of reporting obligations for employees in a mobility situation

Coordination of reporting obligations for employees in a mobility situation

-

Advice on social security

Advice on social security

-

Assistance in labour law

Assistance in labour law

-

Management and protection of your portfolio of property rights

We put the most appropriate protection policy in place for our clients’ intellectual property rights.

-

Securing your projects: advisory and drafting of agreement services

We advise you on the feasibility of your project and the securing of your intellectual property and IT rights.

-

Enforcement of your rights: pre-litigation and litigation

Enforcement of your rights: detection of infringement, pre-litigation and litigation

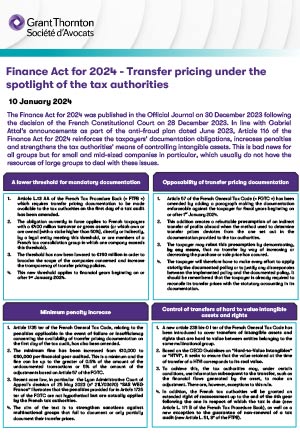

The Finance Act for 2024 was published in the Official Journal on 30 December 2023 following the decision of the French Constitutional Court on 28 December 2023. In line with Gabriel Attal's announcements as part of the anti-fraud plan dated June 2023, Article 116 of the Finance Act for 2024 reinforces the taxpayers' documentation obligations, increases penalties and strengthens the tax authorities' means of controlling intangible assets. This is bad news for all groups but for small and mid-sized companies in particular, which usually do not have the resources of large groups to deal with these issues.

A lower threshold for mandatory documentation

- Article L.13 AA of the French Tax Procedure Book (« FTPB ») which requires transfer pricing documentation to be made available to the tax authorities on the first day of a tax audit has been amended.

- The obligation currently in force applies to French taxpayers with a €400 million turnover or gross assets (or which own or are owned [with a stake higher than 50%], directly or indirectly, by a legal entity meeting this threshold, or are members of a French tax consolidation group in which one company exceeds this threshold).

- The threshold has now been lowered to €150 million in order to broaden the scope of the companies concerned and increase the transparency of transfer pricing policies.

- This new threshold applies to financial years beginning on or after 1er January 2024.

Opposability of transfer pricing documentation

- Article 57 of the French General Tax Code (« FGTC ») has been amended by adding a paragraph making the documentation enforceable against the taxpayer for fiscal years beginning on or after 1er January 2024.

- This addition creates a rebuttable presumption of an indirect transfer of profits abroad when the method used to determine transfer prices deviates from the one set out in the documentation provided to the tax authorities.

- The taxpayer may rebut this presumption by demonstrating, by any means, that no transfer by way of increasing or decreasing the purchase or sale price has occured.

- The taxpayer will therefore have to make every effort to apply strictly the documented policy or to justify any discrepancies between the implemented policy and the documented policy. It should be remembered that the taxpayer is already required to reconcile its transfer prices with the statutory accounting in its documentation.

Minimum penalty increase

- Article 1735 ter of the French General Tax Code, relating to the penalties applicable in the event of failure or insufficiency concerning the availability of transfer pricing documentation on the first day of the tax audit, has also been amended.

- The minimum fine has been increased from €10,000 to €50,000 per financial year audited. This is a minimum and the fine can be up to the greater of 0.5% of the amount of the undocumented transactions or 5% of the amount of the adjustments based on Article 57 of the FGTC.

- Recent case law, in particular the Lyon Administrative Court of Appeal’s decision of 25 May 2023 (n° 21LY03690) "SAS WEG France" illustrates that the penalties provided for in Article 1735 ter of the FGTC are not hypothetical but are actually applied by the French tax authorities.

- The aim of the text is to strengthen sanctions against multinational groups that fail to document or only partially document their transfer prices.

Control of transfers of hard to value intangible assets and rights

- A new article 238 bis-0 I ter of the French General Tax Code has been introduced to cover transfers of intangible assets and rights that are hard to value between entities belonging to the same multinational group.

- Based on the OECD Guidelines on "Hard-to-Value Intangibles" or "HTVI", it seeks to ensure that the value retained at the time of transfer of a HTVI corresponds to its real value.

- To achieve this, the tax authorities may, under certain conditions, use information subsequent to the transfer, such as the financial flows generated by the asset, to make an adjustment. There are, however, exceptions to this rule.

- In addition, the French tax authorities will be granted an extended right of reassessment up to the end of the 6th year following the one in respect of which the tax is due (new Article L. 171 B of the French Tax Procedure Book), as well as a new exception to the guarantee of non-renewal of a tax audit (new Article L. 51, 8° of the FTPB).

Our comments

After years without any new legislation, the transfer pricing regulations have been substantially amended by the Finance Act for 2024. These changes do not go towards reducing the burden on businesses, with the extension of documentation obligations to new taxpayers as a result of the lowering of the threshold for triggering this obligation. This extension comes with the opposability of the documentation (reversal of the burden of proof on the taxpayer), a very significant increase in the applicable penalties (minimum fine multiplied by 5), and a strengthening of the Tax Authorities’ audit tools for hard to value intangible assets and rights (possibility of valuation on the basis of results subsequent to the fiscal year of the transaction, extension of the reassessment period from 3 to 6 years and possibility of renewing an accounting audit).

The end the COVID years marked a significant increase in the attention paid by the French tax authorities to transfer pricing. There is no doubt that tax inspectors will seize on the new arsenal at their disposal to increase the pressure on multinational groups, particularly through the more systematic application of increased documentation-related penalties. In addition, the opposability of transfer pricing documentation is likely to change the face of future disputes, which often focus on the burden of proof of the abnormal nature of transfer prices.

Our team remains at your disposal to assess the impact of these changes on your documentation strategy and your internal reorganisation operations.