-

Tax Policy Management

Tax Policy Management

-

Growth Management

Growth Management

-

Tax audit and litigation

Tax audit and litigation

-

Definition of a strategic and secure transfer pricing structure

Definition of a strategic and secure transfer pricing structure

-

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

-

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

-

Annual declaration and documentation obligations

Annual declaration and documentation obligations

-

Domestic and international VAT applicable to your company's flow

Domestic and international VAT applicable to your company's flow

-

Banking and financial VAT, VAT in the insurance sector

Banking and financial VAT, VAT in the insurance sector

-

VAT related to real estate registration fees

VAT related to real estate registration fees

-

VAT in the public and non-profit / association sector

VAT in the public and non-profit / association sector

-

Tax audit, tax litigation and relations with the Tax authorities

Tax audit, tax litigation and relations with the Tax authorities

-

Applicable rules for invoicing

Applicable rules for invoicing

-

Customs issues related to your company's international flows

Customs issues related to your company's international flows

-

French VAT registration and compliance obligations

French VAT registration and compliance obligations

-

Payroll tax

Payroll tax

-

Other indirect taxation

Other indirect taxation

-

Company transfer diagnosis

Company transfer diagnosis

-

Distribution strategy : Implementing and structuring

Distribution strategy : Implementing and structuring

-

Distribution activities digitalisation

Distribution activities digitalisation

-

Relations between suppliers and distributors

Relations between suppliers and distributors

-

Contractual policy : etablishing and structuring

Contractual policy : etablishing and structuring

-

Controls and litigation regarding payment terms

Controls and litigation regarding payment terms

-

Organising and securing commercial relations with consumers

Organising and securing commercial relations with consumers

-

Data protection - GDPR

Data protection - GDPR

-

Commercial Leases

Support in the management and contract management of commercial leases.

-

Traditional Services offered

Traditional Services offered

-

Health at work and quality of life at work

Health at work and quality of life at work

-

HR Management Audit

HR Management Audit

-

HR Engineering and People Change

Implementing managerial solutions in line with the company's strategic challenges

-

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

-

Advice on legal structuring

Advice on legal structuring

-

Day to day company management

Day to day company management

-

Companies reorganisation

Companies reorganisation

-

Mergers & Acquisitions - Private Equity

Mergers & Acquisitions - Private Equity

-

Changes in shareholder structure - Securities issue

Changes in shareholder structure - Securities issue

-

Governance and legal risks management

Governance and legal risks management

-

Development of an international mobility policy

Development of an international mobility policy

-

Coordination of reporting obligations for employees in a mobility situation

Coordination of reporting obligations for employees in a mobility situation

-

Advice on social security

Advice on social security

-

Assistance in labour law

Assistance in labour law

-

Management and protection of your portfolio of property rights

We put the most appropriate protection policy in place for our clients’ intellectual property rights.

-

Securing your projects: advisory and drafting of agreement services

We advise you on the feasibility of your project and the securing of your intellectual property and IT rights.

-

Enforcement of your rights: pre-litigation and litigation

Enforcement of your rights: detection of infringement, pre-litigation and litigation

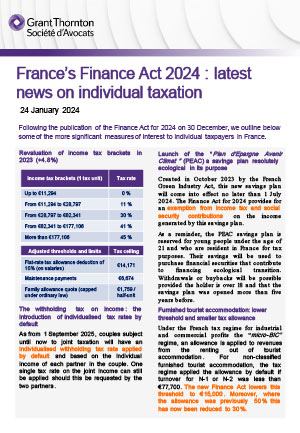

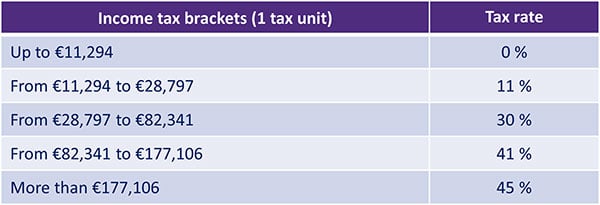

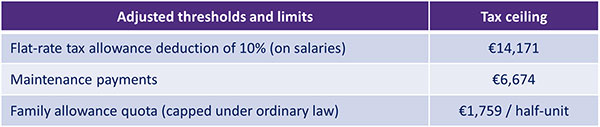

Following the publication of the Finance Act for 2024 on 30 December, we outline below some of the more significant measures of interest to individual taxpayers in France.

Revaluation of income tax brackets in 2023 (+4.8%)

The withholding tax on income: the introduction of individualised tax rates by default

As from 1 September 2025, couples subject until now to joint taxation will have an individualised withholding tax rate applied by default and based on the individual income of each partner in the couple. One single tax rate on the joint income can still be applied should this be requested by the two partners.

Launch of the “Plan d'Epargne Avenir Climat” (PEAC) a savings plan resolutely ecological in its purpose

Created in October 2023 by the French Green Industry Act, this new savings plan will come into effect no later than 1 July 2024. The Finance Act for 2024 provides for an exemption from income tax and social security contributions on the income generated by this savings plan.

As a reminder, the PEAC savings plan is reserved for young people under the age of 21 and who are resident in France for tax purposes. Their savings will be used to purchase financial securities that contribute to financing ecological transition. Withdrawals or buybacks will be possible provided the holder is over 18 and that the savings plan was opened more than five years before.

Furnished tourist accommodation: lower threshold and smaller tax allowance

Under the French tax regime for industrial and commercial profits the “micro-BIC” regime, an allowance is applied to revenues from the renting out of tourist accommodation. For non-classified furnished tourist accommodation, the tax regime applied the allowance by default if turnover for N-1 or N-2 was less than €77,700. The new Finance Act lowers this threshold to €15,000. Moreover, where the allowance was previously 50% this has now been reduced to 30%.

For furnished tourist accommodation which is formally classified as such, an additional allowance of 21% can be applied in certain geographical areas where there is a marked imbalance between the supply and demand, and where the revenues for the previous year do not exceed €15,000.

Wealth tax on property: a change in the valuation method for indirect holdings

The new Finance Act introduces a major change to be implemented as from 2024 on the wealth tax on property.

In the case of indirect holdings, shares in a company will now be subject to the wealth tax on property for their representative value of the property assets or rights. With the exception of those debts that were excluded by virtue of the rules against tax avoidance (Article 973 II of the General Tax Code), it had previously been possible to include debts contracted by the company in the calculation of the wealth tax on property even if they were unrelated to the acquisition of the property.

The principle is therefore to now exclude debts that do not relate to the taxable asset.

A first ceiling will act as a safeguard clause to avoid the imposition of taxation on a basis which is higher than the real value of the assets. The value subject to wealth tax on property may not exceed:

- either the market value of the shares, taking into account all debts;

- or, if the value is lower than that resulting from the first ceiling, the market value of the taxable assets less the debts relating to those assets (proportionate to the taxpayer's shareholding in the company).

The aim of this amendment is to harmonise the rules for valuing direct and indirect holdings. A few additional steps will be necessary in the restatements to be made for indirect holdings.

Transfer of family businesses under the « Pacte Dutreil »: exclusion of property rental activities

The Finance Act amends the definition of a commercial activity in the General Tax Code to be in line with the position already taken by the French tax authorities.

The business activities of furnished rental accommodation, or the rental of commercial property with the operating equipment required, are not eligible for the exemption from transfer duties as provided for under the preferential Dutreil tax regime. The business activity of managing one's own fixed or immovable assets is also expressly excluded.

Businesses whare a mixed civil and commercial activity is operated may benefit from this tax regime if said mixed activity is indeed the principal activity.

Holding companies that manage their group, as defined in the new Article 787 B of the general Tax Code, can benefit from the Dutreil regime if their principal business activity is the management of a group comprising companies which carry out an eligible activity.

- Applicable to the transfer of businesses as from 17 October 2023.

Exit tax: strengthening of sanctions

Where an event gives rise to a tax relief or refund, a specific tax return must be filed for the following year (cases such as the transfer of tax residence to France, an inheritance of gift, death, retention of shares for the required period)

Failure to file this return had not until now given rise to any penalties.

Henceforth, the failure to file this tax return will result in the liability to pay the exit tax.

Inheritance of assets: the non-deductibility of quasi-usufruct debt

In cases where a separate gift of a sum of money had been made, the assets later inherited were reduced by this sum given in bare ownership. In addition to this, the usufructuary retained full ownership of the gifted sum free of tax.

From now on, this sum of previously gifted money is no longer tax deductible from the inherited assets of the estate.

With the exception of:

- proceeds of the sale of a property of which the deceased had reserved the usufruct (and where debts have not been incurred for tax purposes principally);

- usufruct resulting from the transfer of a property from the deceased to the surviving spouse.

The amount of the inherited assets recovered on death will be subject to inheritance tax, after deduction of any inheritance tax paid on gifts.

- Applicable to estate succession files opened from 29 December 2023.

The higher tax reduction rate of 25% under the IR-PME (responsible investment scheme) is extended

The higher tax reduction rate for investments made in socially responsible companies and socially responsible property companies is extended.

- Applicable to investments made up until 31 December 2025.

The tax reduction rate under the IR-PME for young innnovative businesses

A tax reduction of 30% for investments made in young innovative companies (with a maximum investment of €75,000 for a single taxpayer, €150,000 for a couple).

A tax reduction of 50% for investments made in young innovative research companies (with a maximum investment of €50,000 for a single taxpayer, €100,000 for a couple).

Overall multi-annual ceiling: a maximum reduction of €50,000 between 2024 and 2028 per tax household.