-

Tax Policy Management

Tax Policy Management

-

Growth Management

Growth Management

-

Tax audit and litigation

Tax audit and litigation

-

Definition of a strategic and secure transfer pricing structure

Definition of a strategic and secure transfer pricing structure

-

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

-

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

-

Annual declaration and documentation obligations

Annual declaration and documentation obligations

-

Domestic and international VAT applicable to your company's flow

Domestic and international VAT applicable to your company's flow

-

Banking and financial VAT, VAT in the insurance sector

Banking and financial VAT, VAT in the insurance sector

-

VAT related to real estate registration fees

VAT related to real estate registration fees

-

VAT in the public and non-profit / association sector

VAT in the public and non-profit / association sector

-

Tax audit, tax litigation and relations with the Tax authorities

Tax audit, tax litigation and relations with the Tax authorities

-

Applicable rules for invoicing

Applicable rules for invoicing

-

Customs issues related to your company's international flows

Customs issues related to your company's international flows

-

French VAT registration and compliance obligations

French VAT registration and compliance obligations

-

Payroll tax

Payroll tax

-

Other indirect taxation

Other indirect taxation

-

Company transfer diagnosis

Company transfer diagnosis

-

Distribution strategy : Implementing and structuring

Distribution strategy : Implementing and structuring

-

Distribution activities digitalisation

Distribution activities digitalisation

-

Relations between suppliers and distributors

Relations between suppliers and distributors

-

Contractual policy : etablishing and structuring

Contractual policy : etablishing and structuring

-

Controls and litigation regarding payment terms

Controls and litigation regarding payment terms

-

Organising and securing commercial relations with consumers

Organising and securing commercial relations with consumers

-

Data protection - GDPR

Data protection - GDPR

-

Commercial Leases

Support in the management and contract management of commercial leases.

-

Traditional Services offered

Traditional Services offered

-

Health at work and quality of life at work

Health at work and quality of life at work

-

HR Management Audit

HR Management Audit

-

HR Engineering and People Change

Implementing managerial solutions in line with the company's strategic challenges

-

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

-

Advice on legal structuring

Advice on legal structuring

-

Day to day company management

Day to day company management

-

Companies reorganisation

Companies reorganisation

-

Mergers & Acquisitions - Private Equity

Mergers & Acquisitions - Private Equity

-

Changes in shareholder structure - Securities issue

Changes in shareholder structure - Securities issue

-

Governance and legal risks management

Governance and legal risks management

-

Development of an international mobility policy

Development of an international mobility policy

-

Coordination of reporting obligations for employees in a mobility situation

Coordination of reporting obligations for employees in a mobility situation

-

Advice on social security

Advice on social security

-

Assistance in labour law

Assistance in labour law

-

Management and protection of your portfolio of property rights

We put the most appropriate protection policy in place for our clients’ intellectual property rights.

-

Securing your projects: advisory and drafting of agreement services

We advise you on the feasibility of your project and the securing of your intellectual property and IT rights.

-

Enforcement of your rights: pre-litigation and litigation

Enforcement of your rights: detection of infringement, pre-litigation and litigation

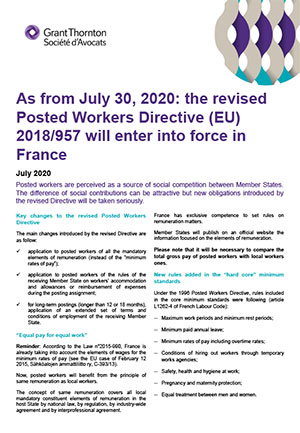

Posted workers are perceived as a source of social competition between Member States. The difference of social contributions can be attractive but new obligations introduced by the revised Directive will be taken seriously.

Key changes to the revised Posted Workers Directive

The main changes introduced by the revised Directive are as follow:

- application to posted workers of all the mandatory elements of remuneration (instead of the “minimum rates of pay”);

- application to posted workers of the rules of the receiving Member State on workers’ accommodation and allowances or reimbursement of expenses during the posting assignment;

- for long-term postings (longer than 12 or 18 months), application of an extended set of terms and conditions of employment of the receiving Member State.

“Equal pay for equal work”

Reminder: According to the Law n°2015-990, France is already taking into account the elements of wages for the minimum rates of pay (see the EU case of February 12 2015, Sähköalojen ammattiliitto ry, C-393/13).

Now, posted workers will benefit from the principle of same remuneration as local workers.

The concept of same remuneration covers all local mandatory constituent elements of remuneration in the host State by national law, by regulation, by industry-wide agreement and by interprofessional agreement.

France has exclusive competence to set rules on remuneration matters.

Member States will publish on an official website the information focused on the elements of remuneration.

Please note that it will be necessary to compare the total gross pay of posted workers with local workers ones.

New rules added in the “hard core” minimum standards

Under the 1996 Posted Workers Directive, rules included in the core minimum standards were following (article L1262-4 of French Labour Code):

- Maximum work periods and minimum rest periods;

- Minimum paid annual leave;

- Minimum rates of pay including overtime rates;

- Conditions of hiring out workers through temporary works agencies;

- Safety, health and hygiene at work;

- Pregnancy and maternity protection;

- Equal treatment between men and women.

The set of core minimum working conditions is expanded to include:

The conditions of an accommodation if provided by the employer applying in the host Member State;

The same mandatory indemnities/allowances as local employees in order to cover expenses actually incurred on account of the posting, such as travel, board and lodging when posted workers are away from home for professional reasons.

The employer must reimburse such expenses in accordance with the national law and/or practice that applies to the employment relationship.

Limitation of the period of assignment

The revised Directive provide that the rules on assignment may be applicable for a maximum of 12 months. The period may be extended by 6 months on the basis of a reasoned notification, without exceeding a total of 18 months.

If the posted worker is replaced by another in the same position, the 12 months will be calculated cumulatively.

The calculation of the 12-month secondment period will also take into account any ongoing postings starting before July 30, 2020.

⚠ With regards to the duration under labour law (18 months) and under social security law (24 months according to the EU Regulation n°883/2004), a distortion could be created. No revision of the EU Regulation for a possible coordination is scheduled yet.

After this period, posted workers are entitled to all mandatory working conditions of the host Member State.

In France, the application of this provision will not be expanded to the company-wide agreements (i.e. the posted worker is not bound to the host company by an employment contract).

However, the revised Directive will exclude from this principle the rules related to the conclusion and termination of employment contracts and the supplementary occupational retirement pension schemes.

Sanctions

- Prohibition or suspension of services provision if non-compliance with rules with respect to posting workers.

- New administrative fines (EUR 4,000 per breach, EUR 8,000 in case of repeated offenses recorded within a period of 2 years).

Our team remains at your disposal for any question you may have in relation to posted workers.

Authors: Anne Frede, Partner, Attorney-at-Law, Caroline Luche-Rocchia, Partner, Attorney-at-Law and Corinne Tonelotto, Attorney-at-law