The Finance Act 2025 was adopted by Parliament on 6 February 2025 and enacted on 14 February 2025.

The legislation concerning individuals is more far-reaching than in previous years. The most significant measures concern the introduction of a minimum tax on high incomes and the regulations on the taxation of management and employee incentive schemes (or management packages).

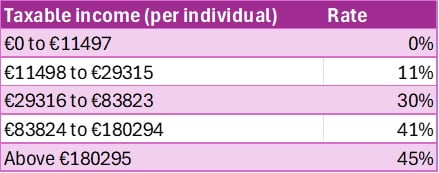

Indexing of tax brackets on income in 2024 (Article 2)

All the tax brackets will be raised by 1.8%:

The standard withholding tax rates will also be adjusted with effect from the 1st day of the 3rd month following the enactment of the law.

Introduction of a tax differential on high incomes (Article 10)

A tax differential on high incomes has been introduced for taxpayers resident in France for tax purposes and whose adjusted reference tax income exceeds €250,000 in the case of single, widowed, separated or divorced individuals, and €500,000 in the case of households subject to joint taxation.

The measure introduces an effective minimum tax rate of 20% for these taxpayers, based on their reference tax income less:

- revenues and income exempt under an international agreement or in application of the impatriate regime (Article 155 B CGI),

- income subject to a flat-rate withholding tax on income (Article 1417, 1°,c CGI), and which was paid before the Finance Act came into force,

- revenues received by an individual inventor and their beneficiaries under Article 238 of the French General Tax Code and which have in fact been taxed at the rate of 10%.

In the case of exceptional income (that which is not earned on an annual basis and which is in excess of the average net income for the last three years) one quarter of the amount is retained and added to the amount of total ordinary income for the calculation of tax payable.

The new contribution equals the difference between 20% of the income defined above and the amount of tax paid, i.e. income tax (increased by any tax benefits provided by tax reductions and up to the limit of the tax due, by certain tax credits), increased by withholding taxes paid after the date of publication of the law and by the Exceptional Contribution on High Income (CEHR) The amount is increased by €12,500 for taxpayers subject to joint taxation and by €1,500 for each dependent.

Exceptional Contribution on High Income (CEHR)

A smoothing mechanism is to be provided for in cases where income is between:

- €250,000 and €330,000 for single taxpayer;

- or €500,000 and €660,000 for households subject to joint taxation.

The contribution will apply to 2025 income only.

An initial instalment representing 95% of the contribution will be paid between 1 December 2025 and 15 December 2025.

In the event of non-payment or late payment of the initial instalment, or in the event of payment of less than 20% of the amount normally due, a 20% surcharge will be applied.

Tax relief for donations

With effect on donations made the day following the enactment of the Finance Act:

- the tax relief rate is increased to 75% for donations made to organisations providing support to victims of domestic violence. (Article 5)

- the 75% tax relief rate for donations made to the French Heritage Foundation « Fondation du Patrimoine » to finance work on religious buildings has now been extended to all public interest foundations engaged in heritage conservation. (Article 9)

Family donations of money for the purchase of a principal residence (Article 71)

Donations made between the day following the enactment of the Finance Act and 31 December 2026 that are used to purchase a newly built property or a property in the process of being completed, or to carry out certain energy-efficiency renovation work on the principal residence, may be exempt from transfer duties.

Sums of money donated must be done so in full ownership to a child, grandchild, great-grandchild or, where there is none, a nephew or niece.

The exemption is subject to:

- A five-year undertaking to keep the property as the main place of residence or to let the property for residential purposes on a five-year lease,

- The beneficiary not having already received tax relief on the same donation,

- The respect of the two financial limits of €100,000 per donor to the same beneficiary, and of a total amount of €300,000 in donations received per beneficiary.

Time limit for the French tax authorities to perform a tax assessment of a declared tax residency (Article 61)

The French tax administration's right to reclaim tax has been extended to the end of the tenth year (instead of the third year) following the year in respect of which the tax is due when an individual claims a false tax residency abroad.

This new deadline applies to an inspection of income tax, property wealth tax and transfer duty returns.

This new right may be applied to reassessment periods expiring on or after the day after the Finance Act is enacted.

Tax treatment of management packages (Article 93)

With effect from the day following the enactment of the Finance Act, earnings from management packages are subject to capital gains tax, up to a ceiling equivalent to three times the company's financial performance during the holding period (see our specific alert on this subject).

Excess gains are taxed as salary and wages (on a progressive scale). The changes to this treatment will apply from the day following the enactment of the law.

A flat-rate employee contribution of 10% applies to the amount of net gains realised on securities subscribed or acquired by employees or directors, or allocated to them, in respect of the performance of their duties within the company issuing the securities or any company in which the latter directly or indirectly holds a share of the capital when these gains are subject to income tax as salaries and wages.

This employee contribution will apply to share disposals up to 31 December 2027.

The Finance Act amends the Social Security Code accordingly (Art. L 137-42).

A tighter legislation on the treatment of subscription warrants or rights and securities acquired on exercise of such warrants or rights (Article 92).

1. Subscription or allocation rights or warrants and securities received on exercise of these rights or warrants may no longer be placed in certain savings plans.

The Finance Act confirms the position of the administrative doctrine by prohibiting:

- The placement of share subscription or allocation rights or warrants in a PEA savings plan (or PEA-PME), except for preferential subscription rights to capital increases in listed securities;

- The placement of securities received on exercise of these subscription or allocation rights or warrants (other than preferential subscription rights for capital increases in listed securities) in a PEA (or a PEA-PME);

- The placement of business creator shares (BSCPEs) and the securities subscribed for on exercise of these warrants in a company savings plan (PEE), a collective retirement savings plan (PERCO) or an inter-company savings plan (PEI)

These new restrictions apply to the above-mentioned rights or warrants allocated or exercised on or after 10 October 2024.

In the case of rights or warrants which have been held in savings plans prior to 10 October 2024, the holder may withdraw them from the plan and make a compensatory cash payment within a maximum of two months from the date of withdrawal for an amount equal to the value of the rights or warrants at that date. This compensatory payment will not be taken into account in the set ceiling amount for authorised payments into the plan.

2. Distinction made between the gain on exercise and the gain on disposal of BSPCEs

The tax treatment of BSCPEs issued since 1 January 2018 made no distinction between the gain on exercise and the gain on disposal and only taxed the net gain arising from the difference between the disposal price of the securities and the issue price of the warrants. This net gain is now subject to income tax under a specific regime for BSPCEs (Article 163 bis G, I of the French General Tax Code).

The Finance Act now makes a clear distinction between two types of gain:

- The gain on exercise of the BSPCEs, equal to the difference between the actual value of the shares on the day of exercise and the acquisition price of the shares set on the day of issuance. This gain is subject to income tax at a flat rate of 12.8% or, if the beneficiary so chooses, at the progressive rate (30% if the beneficiary has been working for the company for less than 3 years), in the year of disposal, sale, conversion to bearer form or lease of the shares subscribed in the exercise of warrants.

- The gain on disposal, equal to the difference between the disposal price and the value of the shares on the day of the exercise. This capital gain is taxed in accordance with the ordinary capital gains tax regime (flat tax), with the possibility of a tax deferral.

The two types of gain are subject to social security contributions as income from assets.

This amendment applies to all “securities subscribed” in the exercise of warrants as from 1st January 2025.

The reinstatement of depreciation for the calculation of capital gains on non-professional furnished rentals (Article 84)

The tax regime for capital gains realised on the disposal of non-professional furnished rental property has been amended.

Presently, taxpayers do not have to add back the depreciation deducted from their rental income in the calculation of the taxable capital gain when the property is disposed of.

For tax purposes and in the calculation of the taxable gain, the initial purchase price of the property must now be reduced by any depreciation deducted during the rental period.

Depreciation relating to building works (construction, reconstruction, extensions or improvements) does not, however, have to be added back.

Certain types of property are exempt from this new rule, such as serviced residences for seniors and students.

This new measure applies to the sale of property from the day following the enactment of the Finance Act.

The tax allowance for retiring executive managers has been extended (Article 70)

Article 150-0 D ter of the French General Tax Code provides for a fixed allowance of €500,000 on capital gains realised by executive managers of SMEs who dispose of their shares on retirement.

This tax credit was set to end on 31 December 2024 but has been extended until 31 December 2031 by the new Finance Act.

Transfer duty and land registration tax on the sale of real estate (Article 116)

The regional councils in France may increase the rate of land registration tax or stamp duty on the sale of real estate to more than 4.50%, without this rate exceeding 5%. This provision would apply temporarily to deeds and agreements signed between 1 April 2025 and 31 March 2028.

This measure cannot be applied when the property purchased is a first-time property for the buyer and is intended for use as his or her principal residence.

Conversely, regional councils may also reduce the rate of or exonerate first-time buyers from land registration tax or stamp duty.

The reduction or exoneration is subject to the purchaser undertaking to use the property exclusively and continuously as their principal residence for a minimum period of five years from the date of acquisition.

The entry into force of these measures depends on the date of the decisions taken by the departmental councils.