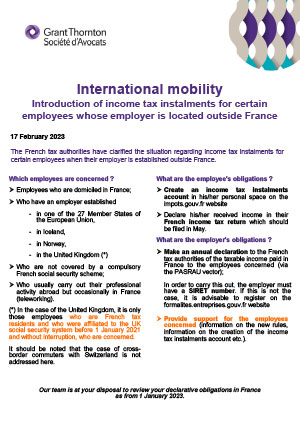

The French tax authorities have clarified the situation regarding income tax instalments for certain employees when their employer is established outside France.

Which employees are concerned?

- Employees who are domiciled in France;

- Who have an employer established

- In one of the 27 Member States of the European Union,

- In Iceland,

- In Norway,

- In the United Kingdom (*)

- Who are not covered by a compulsory French social security scheme;

- Who usually carry out their professional activity abroad but occasionally in France (teleworking).

(*) In the case of the United Kingdom, it is only those employees who are French tax residents and who were affiliated to the UK social security system before 1 January 2021 and without interruption, who are concerned.

It should be noted that the case of cross-border commuters with Switzerland is not addressed here.

What are the employee’s obligations?

- Create an income tax instalments account in his/her personal space on the impots.gouv.fr website,

- Declare his/her received income in their French income tax return which should be filed in May.

What are the employer’s obligations?

- Make an annual declaration to the French tax authorities of the taxable income paid in France to the employees concerned (via the PASRAU vector);

In order to carry this out, the employer must have a SIRET number. If this is not the case, it is advisable to register on the formalites.entreprises.gouv.fr website.

- Provide support for the employees concerned (information on the new rules, information on the creation of the income tax instalments account etc.).

Our team is at your disposal to review your declarative obligations in France as from 1 January 2023.