-

Tax Policy Management

Tax Policy Management

-

Growth Management

Growth Management

-

Tax audit and litigation

Tax audit and litigation

-

Definition of a strategic and secure transfer pricing structure

Definition of a strategic and secure transfer pricing structure

-

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

Assistance in the development of international activities and operational reorganisations – “Business restructuring”

-

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

Defense of practices and assistance in the context of tax audits and their follow-up from a litigation viewpoint

-

Annual declaration and documentation obligations

Annual declaration and documentation obligations

-

Domestic and international VAT applicable to your company's flow

Domestic and international VAT applicable to your company's flow

-

Banking and financial VAT, VAT in the insurance sector

Banking and financial VAT, VAT in the insurance sector

-

VAT related to real estate registration fees

VAT related to real estate registration fees

-

VAT in the public and non-profit / association sector

VAT in the public and non-profit / association sector

-

Tax audit, tax litigation and relations with the Tax authorities

Tax audit, tax litigation and relations with the Tax authorities

-

Applicable rules for invoicing

Applicable rules for invoicing

-

Customs issues related to your company's international flows

Customs issues related to your company's international flows

-

French VAT registration and compliance obligations

French VAT registration and compliance obligations

-

Payroll tax

Payroll tax

-

Other indirect taxation

Other indirect taxation

-

Company transfer diagnosis

Company transfer diagnosis

-

Distribution strategy : Implementing and structuring

Distribution strategy : Implementing and structuring

-

Distribution activities digitalisation

Distribution activities digitalisation

-

Relations between suppliers and distributors

Relations between suppliers and distributors

-

Contractual policy : etablishing and structuring

Contractual policy : etablishing and structuring

-

Controls and litigation regarding payment terms

Controls and litigation regarding payment terms

-

Organising and securing commercial relations with consumers

Organising and securing commercial relations with consumers

-

Data protection - GDPR

Data protection - GDPR

-

Commercial Leases

Support in the management and contract management of commercial leases.

-

Traditional Services offered

Traditional Services offered

-

Health at work and quality of life at work

Health at work and quality of life at work

-

HR Management Audit

HR Management Audit

-

HR Engineering and People Change

Implementing managerial solutions in line with the company's strategic challenges

-

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

Management of HR compliance and internal investigations (harassment, discrimination, and whistleblowing)

-

Advice on legal structuring

Advice on legal structuring

-

Day to day company management

Day to day company management

-

Companies reorganisation

Companies reorganisation

-

Mergers & Acquisitions - Private Equity

Mergers & Acquisitions - Private Equity

-

Changes in shareholder structure - Securities issue

Changes in shareholder structure - Securities issue

-

Governance and legal risks management

Governance and legal risks management

-

Development of an international mobility policy

Development of an international mobility policy

-

Coordination of reporting obligations for employees in a mobility situation

Coordination of reporting obligations for employees in a mobility situation

-

Advice on social security

Advice on social security

-

Assistance in labour law

Assistance in labour law

-

Management and protection of your portfolio of property rights

We put the most appropriate protection policy in place for our clients’ intellectual property rights.

-

Securing your projects: advisory and drafting of agreement services

We advise you on the feasibility of your project and the securing of your intellectual property and IT rights.

-

Enforcement of your rights: pre-litigation and litigation

Enforcement of your rights: detection of infringement, pre-litigation and litigation

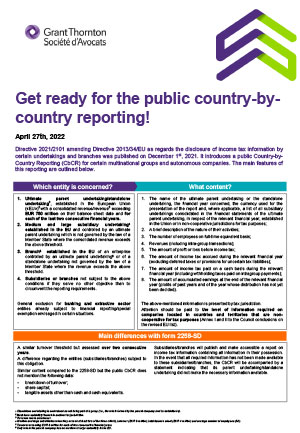

Directive 2021/2101 amending Directive 2013/34/EU as regards the disclosure of income tax information by certain undertakings and branches was published on December 1st, 2021. It introduces a public Country-by-Country Reporting (CbCR) for certain multinational groups and autonomous companies. The main features of this reporting are outlined below.

Which entity is concerned?

- Ultimate parent undertaking/standalone undertaking1, established in the European Union («EU»)2 with a consolidated revenue/revenue3 exceeding EUR 750 million on their balance sheet date and for each of the last two consecutive financial years.

- Medium and large subsidiary undertaking4 established in the EU and controlled by an ultimate parent undertaking which is not governed by the law of a Member State where the consolidated revenue exceeds the above threshold.

- Branch5 established in the EU of an enterprise controlled by an ultimate parent undertaking6 or of a standalone undertaking not governed by the law of a Member State where the revenue exceeds the above threshold.

- Subsidiaries or branches not subject to the above conditions if they serve no other objective than to circumvent the reporting requirements.

General exclusion for banking and extractive sector entities already subject to financial reporting/special exemption envisaged in certain situations.

What content?

- The name of the ultimate parent undertaking or the standalone undertaking, the financial year concerned, the currency used for the presentation of the report and, where applicable, a list of all subsidiary undertakings consolidated in the financial statements of the ultimate parent undertaking, in respect of the relevant financial year, established in the Union or in non-cooperative jurisdictions for tax purposes;

- A brief description of the nature of their activities;

- The number of employees on full-time equivalent basis;

- Revenues (including intra-group transactions);

- The amount of profit or loss before income tax;

- The amount of income tax accrued during the relevant financial year (excluding deferred taxes or provisions for uncertain tax liabilities);

- The amount of income tax paid on a cash basis during the relevant financial year (including withholding taxes paid on intragroup payments);

- The amount of accumulated earnings at the end of the relevant financial year (profits of past years and of the year whose distribution has not yet been decided).

The above-mentioned information is presented by tax jurisdiction.

Attention should be paid to the level of information required on companies located in countries and territories that are non-cooperative for tax purposes (Annex I and II to the Council conclusions on the revised EU list).

Main differences with form 2258-SD:

A similar turnover threshold but assessed over two consecutive years.

A difference regarding the entities (subsidiaries/branches) subject to this obligation.

Similar content compared to the 2258-SD but the public CbCR does not mention the following data:

- breakdown of turnover;

- share capital;

- tangible assets other than cash and cash equivalents.

Subsidiaries/branches will publish and make accessible a report on income tax information containing all information in their possession. In the event that all required information has not been made available to these subsidiaries/branches, the CbCR will be accompanied by a statement indicating that its parent undertaking/standalone undertaking did not make the necessary information available.

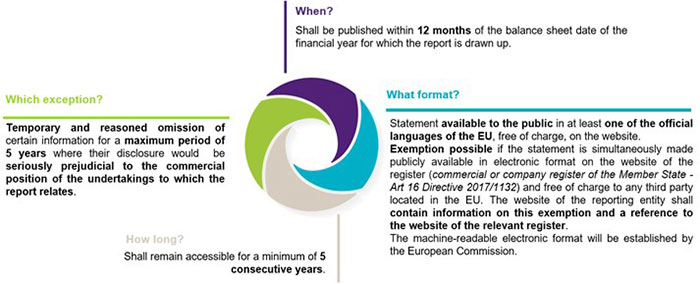

Sanctions and associated responsibilities:

Non-compliance with the reporting obligation will be sanctioned by measures taken at the level of each Member State.

The Directive specifies that the administrative, management and supervisory bodies of the reporting entity or persons designated to carry out the disclosure formalities have a collective responsibility to ensure that the information statement is prepared, published and accessible.

Finally, Member States will require the auditors responsible for certifying the accounts of the reporting entity to mention in the audit report whether the company is required to publish such a statement and whether it has been published.

The next steps:

Following the publication of the Directive in the Official Journal, Member States have until June 22nd, 2023 to transpose it into national law.

The first declarations should therefore relate to financial years beginning on or after July 1st, 2024.

It should be recalled that in France, a public country-by-country declaration voted in the framework of the Sapin II law (law of 9 December 2016) was censured by the Constitutional Council.

There is still some way to go before the implementation of this Directive into French law. In the meantime, clarifications concerning the conditions of application of this new obligation will be welcome.

1 Standalone undertaking is understood as not being part of a group (i.e., the whole formed by the parent company and its subsidiaries).

2 Must have subsidiary/branch in another tax jurisdiction.

3 Revenue refers as turnover.

4 Medium and large subsidiaries when they exceed at least two of the three criteria, turnover (EUR 8 million), total balance sheet (EUR 4 million) and average number of employees (50).

5 Turnover exceeding EUR 8 million for each of two consecutive financial years.

6 Only where the parent company has no medium or large subsidiary in the EU.