-

Pilotage de la politique fiscale

Pilotage de la politique fiscale

-

Gestion de la croissance

Gestion de la croissance

-

Contrôle et contentieux fiscal

Contrôle et contentieux fiscal

-

Structuration stratégique et sécurisée des prix de transfert

Accompagnement à la définition d’une structuration stratégique et sécurisée des prix de transfert

-

Activités à l’international et Business restructuring

Accompagnement au développement des activités à l’international et aux réorganisations opérationnelles « Business restructuring »

-

Contrôles fiscaux en matière de prix de transfert

Assurer la défense des pratiques dans le cadre des contrôles fiscaux et de leur suite

-

Obligations déclaratives accrues et généralisées

Répondre aux obligations déclaratives accrues et généralisées

-

TVA domestique et internationale applicable à vos flux

TVA domestique et internationale applicable à vos flux

-

TVA bancaire et financière, TVA dans le secteur assurance

TVA bancaire et financière, TVA dans le secteur assurance

-

TVA immobilière et droits d’enregistrement (DE)

TVA immobilière et droits d’enregistrement (DE)

-

TVA dans le secteur public et associatif

TVA dans le secteur public et associatif

-

TVA, contentieux fiscal et relations avec l’Administration

Contrôle fiscal, contentieux fiscal et relations avec l’Administration fiscale

-

Règles applicables en matière de facturation

Règles applicables en matière de facturation

-

Problématiques douanières liées à vos flux internationaux

Problématiques douanières liées à vos flux internationaux

-

Obligations déclaratives et d’immatriculation à la TVA

Obligations d’immatriculation à la TVA et obligations déclaratives (TVA, DEB, DES)

-

Taxe sur les salaires

Taxe sur les salaires

-

Autres taxes indirectes

Autres taxes indirectes

-

Le Diag Transmission

Nous vous aidons à anticiper et appréhender votre opération de transmission

-

Stratégie de distribution

Mise en place et structuration de votre stratégie de distribution

-

Digitalisation des activités de distribution

Digitalisation des activités de distribution

-

Relations entre fournisseurs et distributeurs

Gérer vos relations avec vos fournisseurs et distributeurs

-

Politique contractuelle des entreprises

Mise en place et structuration de votre politique contractuelle

-

Contrôle et contentieux en matière de délais de paiement

Contrôle et contentieux en matière de délais de paiement

-

Relations commerciales avec les consommateurs

Organisation et sécurisation de vos relations commerciales avec les consommateurs

-

Droit des données personnelles - RGPD

Droit des données personnelles – conseil en RGPD

-

Baux commerciaux

Un accompagnement dans la gestion et le Contract Management des baux commerciaux.

-

Prestations traditionnelles

Prestations traditionnelles en droit social

-

Santé au travail et qualité de vie au travail

Assurer une plus grande souplesse dans l’organisation du temps de travail et améliorer la qualité de vie au travail

-

Audit du Management des Ressources Humaines

Auditer des prestations de service de la fonction RH au Groupe

-

Ingénierie RH & People Change

Mettre en place des réponses managériales en réponse aux enjeux stratégiques de l’entreprise

-

Gestion de la conformité RH et des enquêtes internes

Gestion de la conformité RH : harcèlement, discrimination et dénonciation…

-

Conseil dans la structuration juridique

Conseil dans la structuration juridique

-

Gestion courante des entreprises

Gestion courante des entreprises

-

Réorganisation d’entreprises

Réorganisation d’entreprises

-

Cession et acquisition d’entreprises

Cession et acquisition d’entreprises

-

Evolution de l’actionnariat – Emission de valeurs mobilières

Evolution de l’actionnariat – Emission de valeurs mobilières

-

Gouvernance et maîtrise des risques juridiques

Gouvernance et maîtrise des risques juridiques

-

Développement d’une politique de mobilité internationale

Développement d’une politique de mobilité internationale

-

Mobilité - Obligations déclaratives des salariés

Coordination des obligations déclaratives des salariés en situation de mobilité

-

Conseil en matière de sécurité sociale

Conseil en matière de sécurité sociale

-

Assistance en matière de droit du travail

Assistance en matière de droit du travail

-

La gestion et l’exploitation de vos portefeuilles de droits

Nous établissons avec nos clients la politique de protection de leurs droits de propriété intellectuelle la plus adaptée à leurs projets.

-

La sécurisation de vos projets : conseil et rédaction contractuelle

Conseil en matière de propriété intellectuelle, de droit de la publicité, politique contractuelle en matière de droit d’auteur et droit à l’image.

-

La défense de vos droits : précontentieux et contentieux

La défense de vos droits : détection des atteintes, précontentieux et contentieux

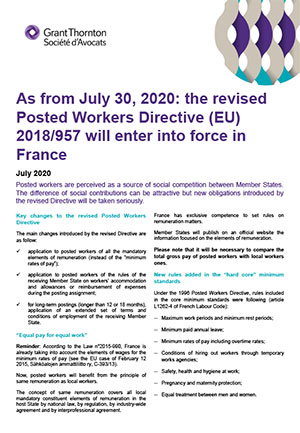

Posted workers are perceived as a source of social competition between Member States. The difference of social contributions can be attractive but new obligations introduced by the revised Directive will be taken seriously.

Key changes to the revised Posted Workers Directive

The main changes introduced by the revised Directive are as follow:

- application to posted workers of all the mandatory elements of remuneration (instead of the “minimum rates of pay”);

- application to posted workers of the rules of the receiving Member State on workers’ accommodation and allowances or reimbursement of expenses during the posting assignment;

- for long-term postings (longer than 12 or 18 months), application of an extended set of terms and conditions of employment of the receiving Member State.

“Equal pay for equal work”

Reminder: According to the Law n°2015-990, France is already taking into account the elements of wages for the minimum rates of pay (see the EU case of February 12 2015, Sähköalojen ammattiliitto ry, C-393/13).

Now, posted workers will benefit from the principle of same remuneration as local workers.

The concept of same remuneration covers all local mandatory constituent elements of remuneration in the host State by national law, by regulation, by industry-wide agreement and by interprofessional agreement.

France has exclusive competence to set rules on remuneration matters.

Member States will publish on an official website the information focused on the elements of remuneration.

Please note that it will be necessary to compare the total gross pay of posted workers with local workers ones.

New rules added in the “hard core” minimum standards

Under the 1996 Posted Workers Directive, rules included in the core minimum standards were following (article L1262-4 of French Labour Code):

- Maximum work periods and minimum rest periods;

- Minimum paid annual leave;

- Minimum rates of pay including overtime rates;

- Conditions of hiring out workers through temporary works agencies;

- Safety, health and hygiene at work;

- Pregnancy and maternity protection;

- Equal treatment between men and women.

The set of core minimum working conditions is expanded to include:

The conditions of an accommodation if provided by the employer applying in the host Member State;

The same mandatory indemnities/allowances as local employees in order to cover expenses actually incurred on account of the posting, such as travel, board and lodging when posted workers are away from home for professional reasons.

The employer must reimburse such expenses in accordance with the national law and/or practice that applies to the employment relationship.

Limitation of the period of assignment

The revised Directive provide that the rules on assignment may be applicable for a maximum of 12 months. The period may be extended by 6 months on the basis of a reasoned notification, without exceeding a total of 18 months.

If the posted worker is replaced by another in the same position, the 12 months will be calculated cumulatively.

The calculation of the 12-month secondment period will also take into account any ongoing postings starting before July 30, 2020.

⚠ With regards to the duration under labour law (18 months) and under social security law (24 months according to the EU Regulation n°883/2004), a distortion could be created. No revision of the EU Regulation for a possible coordination is scheduled yet.

After this period, posted workers are entitled to all mandatory working conditions of the host Member State.

In France, the application of this provision will not be expanded to the company-wide agreements (i.e. the posted worker is not bound to the host company by an employment contract).

However, the revised Directive will exclude from this principle the rules related to the conclusion and termination of employment contracts and the supplementary occupational retirement pension schemes.

Sanctions

- Prohibition or suspension of services provision if non-compliance with rules with respect to posting workers.

- New administrative fines (EUR 4,000 per breach, EUR 8,000 in case of repeated offenses recorded within a period of 2 years).

Our team remains at your disposal for any question you may have in relation to posted workers.

Authors: Anne Frede, Partner, Attorney-at-Law, Caroline Luche-Rocchia, Partner, Attorney-at-Law and Corinne Tonelotto, Attorney-at-law